The dairy industry plays a vital role in Europe's agricultural sector and has significant economic and social implications. Understanding milk prices and trends in the milk market is crucial for a wide range of stakeholders including producers, dairy processors, retailers, policy makers, and dairy practitioners. Changes in milk prices can have profound implications in the financial viability of dairy farms, investment decisions and market competitiveness. Consumption of milk and dairy products in Europe is also substantial, with dairy products being a crucial part of European diets apart from the economic weight of exportations.

The EU is a major producer of milk and dairy products, which are part of the Common Organization of Agricultural Markets (CMO). Milk is produced in all European countries, representing a significant percentage of Europe's agricultural production, estimated at around 155 million tons per year. Germany, France, Poland, the Netherlands, Italy, and Ireland are among the main producers [1].

Average prices in Europe

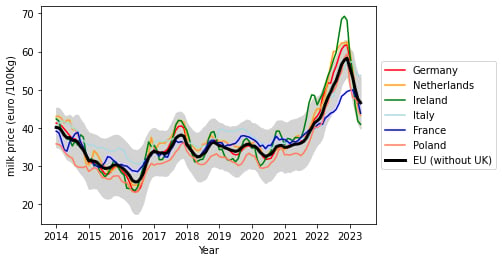

According to the Milk Market Observatory in Europe, the average EU cow´s raw milk price in January 2021 was €34.87/100Kg milk. In the following months, the average price increased reaching €35.77/100 kg in the middle of the year. It continued to rise, reaching €41.28/100 kg in December [2].

It should be remembered that in 2020, the beginning of the Covid-19 pandemic brought unprecedented challenges to the Dairy Industry. Lockdown measures and restrictions affected demand from the food service sector, leading to a glut of milk and consequently, milk prices fell in many countries across Europe as supply outstripped demand [3].

In 2021, the recovery of the decline in the price of milk in Europe, caused by the pandemic, began to take place. As the food service sector reopened, demand for dairy products recovered and milk prices showed a positive trajectory.

However, inflationary pressures and rising production costs, including the price of animal feed and energy, posed new challenges for producers. The shortage of labor in certain regions also impacted the price of milk [4].

In 2022, a significant increase in the price of milk in the EU was registered, raising to an average of 41.81€/100Kg of milk in January. The price of milk increased, reaching highs of €52.37/100Kg in August and even reaching €58.25/100Kg at the end of the year. For a better analysis of milk prices in the EU, one should evaluate the variances of the main milk producing countries in Europe[2].

Comparing average raw milk prices in January 2021, and prices in December 2022, Ireland was the country with the highest growth in raw milk prices, followed by the Netherlands and Poland.

Table 1. Average raw milk prices in the six main producers in the EU [2].

|

Sales prices (€/100kg) |

Germany |

France |

Poland |

Italy |

Ireland |

Netherland |

|

January 2021 (€) |

34.71 |

36.94 |

32.91 |

35.97 |

35.64 |

34.25 |

|

December 2022 (€) |

61.72 |

49.51 |

59.39 |

57.40 |

68.18 |

62.51 |

|

Increase percentage (%) |

77.82 |

34.03 |

80.46 |

59.58 |

91.30 |

82.51 |

As for the first quarter of 2023, it was verified in all these countries, a tendency for the price of milk to decrease, of around 13% compared to the end of 2022 [2].

Graphic 1. Average raw milk prices of milk in EU

Average raw milk prices in EU increased by 31% in 2022 compared to 2021. This may be attributed to three main factors [5]:

- Russian Invasion of Ukraine: Russia and Ukraine are major exporters of cereals, wheat, maize, sunflower oil, and fertilizers.

- Widespread drought that reduces the profitability of the land, so less hay/feed for livestock was produced.

- The cost of energy which has soared as steps have been taken to eliminate Europe's dependence on Russian fossil fuels.

EU raw milk prices declined in January 2023, after 24 months of uninterrupted growth, reaching €55.5/100Kg of milk in February.

Milk Prices Trend

Milk prices in Europe experienced fluctuations due to the impact of the Covid-19 pandemic, with a decline in 2020 and subsequent recovery in 2021. The negative impact of the Covid-19 pandemic on livestock included a decrease in purchasing power and demand for livestock products at the public level, reduced profitability for farmers, increased production costs, limitation of veterinary services, livestock distribution and interruption of commercialization aspects and business slowdown [3].

In 2022, milk prices in the EU showed a significant increase, reaching their highest levels in years. This increase was mainly driven by three factors: the Russian invasion of Ukraine, widespread drought impacting feed production, and the rising cost of energy. These factors had a significant impact on milk production and subsequently influenced prices [5].

However, during the first quarter of 2023, a downward trend in milk prices was observed across the EU. This decline can be attributed to various factors, including increased supply and reduced demand.

This year, declining EU milk prices are likely to lead to increased slaughtering as feed and other input costs could remain high. The European Commission expects the overall EU dairy herd could shrink by 1%. Higher beef prices could incentivise this. The decline in the dairy herd could also be compensated by increasing yields, assuming normal weather patterns return [6].

For 2023, a prolonged slowdown of the global economy is expected and consequently, the price of raw milk in the European Union will probably remain low.

With the imminent recession, inflation and record demand we might expected prices to fall and overcome the supply imbalance.

The milk price paid to producers in January 2023 varied depending on the EU countries. Thus, in countries such as Ireland, Poland and the Netherlands, 2023 started on a downward trend, breaking the upward trend since January 2021, namely the drop in Ireland was 0.6 €/100 Kg raw milk compared to December 2022, the decline in Poland was 0.8€/100Kg of raw milk also compared to the end of 2022 and the Netherlands recorded a reduction of 2.5€/100Kg of raw milk compared to the same period.

On the other hand, in some EU countries there was an increase in raw milk prices, such as Germany, France and Spain.[7]

Taking into account that production costs remain very high, specifically the increase in the price of animal feed, fuel, energy, fertilizers, seeds and phytopharmaceuticals, the projection of the price of raw milk will be for an increase or maintenance in 2023, in most countries in Europe.[8]

Final considerations

Overall, understanding milk price trends is essential for the dairy industry and its stakeholders to make informed decisions, adapt to market dynamics, and ensure the sustainability of dairy farming in Europe. However, in the current situation of stable instability, understanding trends is not enough, and outlier events should also be considered.

References

[1] European Comission, Milk and dairy products, Milk and Dairy Products. (2022).

[2] European Comission, Milk Market Observatory, 2023.

[3] H. Mayulu, E. Sawitri, I. Tricahyadinata, The Impact of Covid-19 Pandemic on the Livestock Subsector, Jurnal Sains Dan Kesehatan. 5 (2023). https://www.doi.org//10.25026/jsk.v5i2.1760.

[4] J. Byrne, High feed prices, inflationary pressure and supply chain disruptions to be common themes again in 2022, FeedNavigator. (2022). https://www-feednavigator-com.translate.goog/Article/2022/01/13/High-feed-prices-inflationary-pressure-and-supply-chain-disruptions-to-be-common-themes-again-in-2022 (accessed June 13, 2023).

[5] EFA News - European Food Agency, Increase the price of agricultural goods in the EU, Increase the Price of Agricultural Goods in the EU. (2023). https://www.efanews.eu/item/28463-increase-the-price-of-agricultural-goods-in-the-eu.html (accessed June 13, 2023).

[6] Tony McDougal, Short-term outlook for EU milk and dairy products, Dairy Global. (2023).

[7] José Ignacio Falces, El precio de la leche de vaca en Europa inicia el año a la baja perdiendo 0,5 euros hasta los 56,97 €/100 kg, Agronews Castilla y León. (2023). https://www.agronewscastillayleon.com/el-precio-de-la-leche-de-vaca-en-europa-inicia-el-ano-la-baja-perdiendo-05-euros-hasta-los-5697 (accessed July 7, 2023).

[8] Lusa/Sic Notícias, Subida do preço do leite tardia e abrupta, mas necessária, dizem produtores, SIC Noticias. (2022). https://sicnoticias.pt/economia/2022-12-17-Subida-do-preco-do-leite-tardia-e-abrupta-mas-necessaria-dizem-produtores-de74a849 (accessed July 7, 2023).

About the author

Ana Vanessa Dias Sousa (Researcher FeedInov CoLAB)

With a degree in Veterinary Sciences from the University of Trás-os-Montes and Alto Douro, she worked for five years as a field veterinarian and in a pig and cattle feed factory. She worked in the pharmaceutical industry as a sales manager and technical support for pigs, cattle, rabbits and poultry in mainland Portugal and the Azores. She is currently at Feedinov Colab as a Researcher in the One Health Department.

Explore author’s articles

Leave your comments here